The decentralized finance (DeFi) landscape has been rapidly evolving, providing innovative solutions for trading, investing, and managing assets on blockchain platforms. One platform making significant strides in this space is EtherEx, a decentralized exchange that allows users to trade Ethereum-based assets seamlessly. As traditional finance encounters barriers and inefficiencies, EtherEx aims to simplify the trading process, enhance liquidity, and empower users with full control over their digital assets. This article will explore EtherEx's vision, key features, benefits, challenges, and its potential impact on the DeFi ecosystem.

Overview

EtherEx is a decentralized exchange (DEX) built specifically for the Ethereum ecosystem, facilitating the trading of Ethereum-based tokens in a trustless and efficient environment. Unlike conventional exchanges, which require users to deposit funds and trust the platform to manage their assets, EtherEx allows users to retain control over their private keys and funds throughout the trading process. This innovation aligns with the broader ethos of blockchain technology—decentralization, transparency, and user empowerment.

Vision and Mission

The vision of EtherEx is to create a secure, user-friendly platform that democratizes access to decentralized trading. Its mission is to provide an alternative to centralized exchanges by empowering users to trade directly from their wallets, thereby eliminating counterparty risk and enhancing financial sovereignty.

1. Non-Custodial Trading

EtherEx operates on a non-custodial model, meaning users retain full control of their assets at all times. Unlike centralized exchanges that require users to deposit funds into their platforms, EtherEx facilitates peer-to-peer trading directly from users' wallets. This eliminates the risk of hacks or mismanagement that often plagues centralized exchanges.

2. Automated Market Maker (AMM) Model

EtherEx employs an Automated Market Maker (AMM) model instead of traditional order book trading. In an AMM system, liquidity providers deposit assets into liquidity pools, which are then used to facilitate trades. This model allows for continuous liquidity, enabling users to trade at any time without waiting for buy or sell orders to be matched.

3. Liquidity Pools

The liquidity pools on EtherEx are essential for ensuring smooth and efficient trading. Users can contribute to these pools by depositing their tokens and earn rewards in the form of transaction fees. This incentivizes users to provide liquidity while enhancing the available trading pairs and improving price stability.

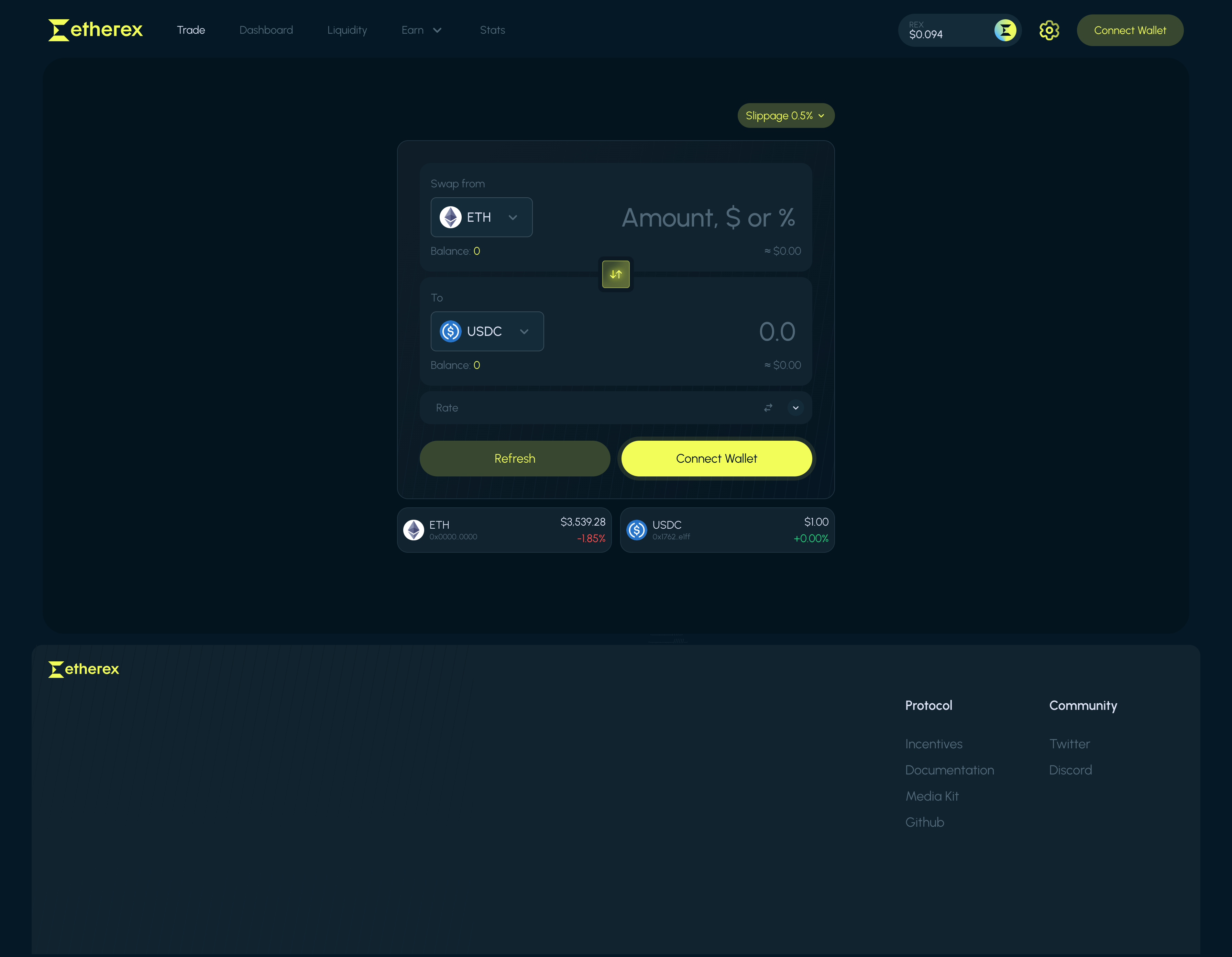

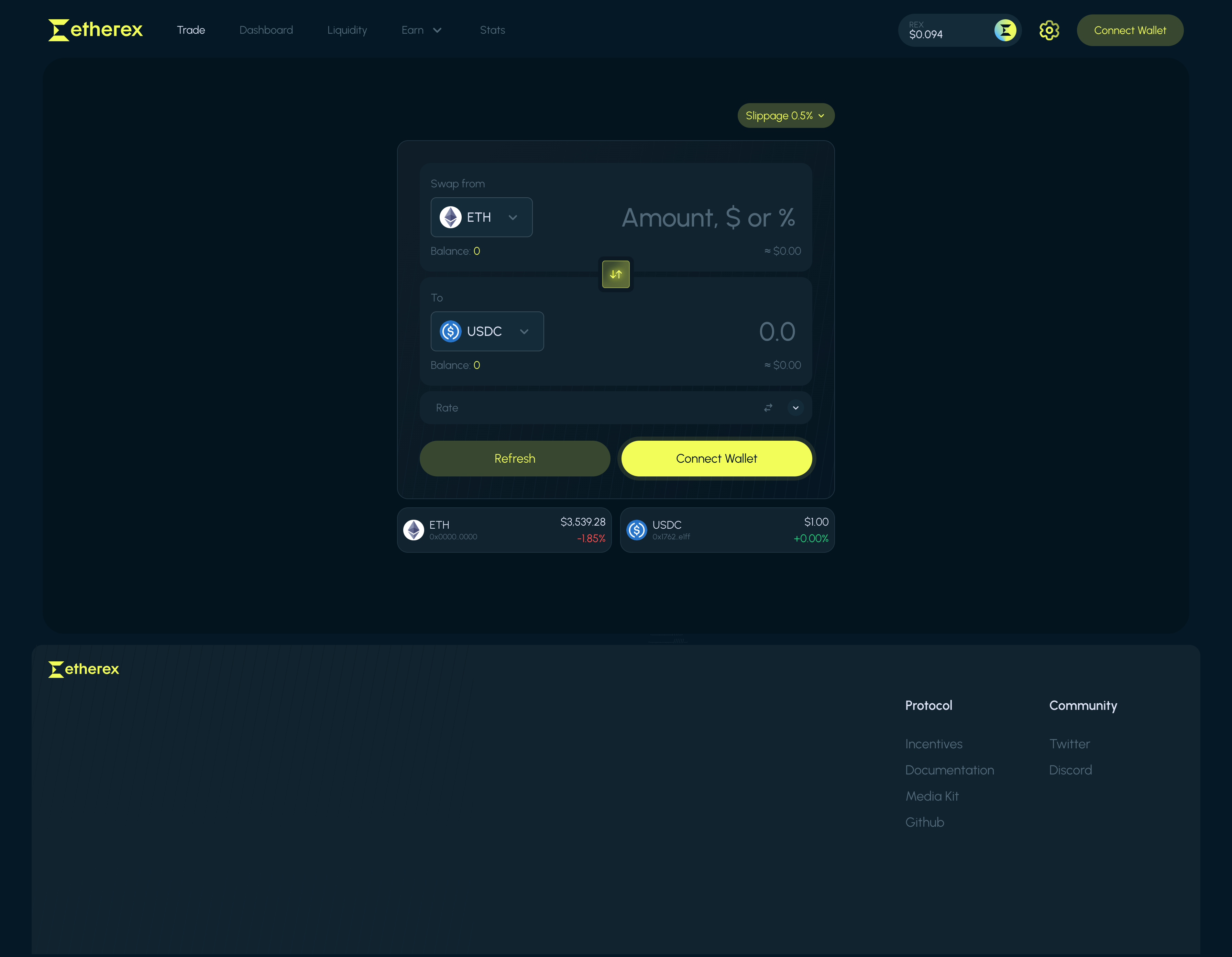

4. User-Friendly Interface

EtherEx is designed with a focus on user experience, featuring a clean and intuitive interface that simplifies the trading process. Users can easily navigate through various assets, view real-time price information, and execute trades with just a few clicks.

5. Support for ERC-20 Tokens

As a platform built on the Ethereum blockchain, EtherEx supports a wide array of ERC-20 tokens. This extensive support enables users to trade popular tokens such as AAVE, LINK, DAI, and many others within the Ethereum ecosystem. This diversity allows for effective portfolio management and maximizes trading opportunities.

6. Security Measures

Security is a paramount concern for EtherEx. The platform implements industry-standard security measures, including smart contract audits and secure wallet integration. By prioritizing security, EtherEx aims to build trust and confidence among its users.

7. Community Governance

EtherEx emphasizes community involvement by adopting a decentralized governance model. Users holding EtherEx tokens can propose and vote on changes to the platform, ensuring that the future development aligns with the community's desires and needs.

1. Enhanced Control

EtherEx allows users to trade directly from their wallets, giving them full control over their assets. This decentralized model reduces the risks associated with centralized exchanges, such as hacking or mismanagement of funds.

2. Lower Fees

Due to its non-custodial nature and AMM model, EtherEx typically has lower trading fees compared to centralized exchanges. Users can save on fees that might otherwise be associated with deposits, withdrawals, and trades on traditional platforms.

3. Transparent Operations

The decentralized nature of EtherEx ensures full transparency in trading operations. Transactions are recorded on the blockchain, enabling users to verify trades and liquidity movements independently.

4. Wide Asset Variety

With support for numerous ERC-20 tokens, EtherEx offers a vast array of trading options, allowing users to diversify their portfolios effectively. The platform's flexibility makes it suitable for both casual traders and dedicated investors.

5. Community Engagement

The decentralized governance model empowers users to actively participate in the platform's evolution. By allowing token holders to propose and vote on significant changes, EtherEx fosters a strong community spirit and encourages collaboration among users.

Step 1: Create a Wallet

To use EtherEx, users need to set up a compatible cryptocurrency wallet that supports Ethereum and ERC-20 tokens. Popular choices include MetaMask, Trust Wallet, and Ledger hardware wallets.

Step 2: Fund Your Wallet

Once the wallet is set up, users can purchase Ether (ETH) or other ERC-20 tokens from external exchanges. After acquiring the assets, users can transfer them to their EtherEx-compatible wallet.

Step 3: Access EtherEx

With a funded wallet, users can navigate to the EtherEx platform via its official website. The wallet can be connected to the platform, allowing users to interact with EtherEx seamlessly.

Step 4: Trade Assets

Users can initiate trades by selecting their desired trading pairs. The user-friendly interface provides real-time data on prices and trading volumes, enabling users to make informed decisions.

Step 5: Provide Liquidity

For users looking to earn rewards, contributing to liquidity pools is a straightforward process. By depositing tokens into the pools, users can earn a share of the transaction fees generated from trading activities.

Step 6: Engage with the Community

EtherEx encourages users to engage in community discussions and governance. Participating in forums and social media channels allows users to share insights and collaborate on the platform's future.

1. Market Volatility

The cryptocurrency market is characterized by high volatility, which can impact asset prices significantly. Traders on EtherEx must be prepared to navigate rapid price fluctuations and implement risk management strategies to safeguard their investments.

2. Learning Curve

While EtherEx strives to provide a user-friendly experience, newcomers to DeFi may still encounter a learning curve. Understanding liquidity pools, AMM mechanisms, and the overall trading process requires some familiarity with decentralized finance concepts.

3. Security Risks

Despite EtherEx's commitment to security, users should remain vigilant and practice good security hygiene. This includes safeguarding private keys, using secure passwords, and staying informed about potential phishing attempts.

4. Regulatory Environment

As the DeFi landscape develops, regulatory scrutiny is likely to increase. EtherEx must navigate the evolving regulatory landscape to ensure compliance without compromising its decentralized ethos.

1. Expansion of Asset Offerings

To maintain its competitive edge, EtherEx may expand its asset offerings by adding new ERC-20 tokens and exploring partnerships with emerging projects. This expansion could attract a broader user base and provide traders with more opportunities.

2. Enhanced Trading Features

EtherEx could continue to enhance its platform by incorporating advanced trading features, such as limit orders, stop-loss mechanisms, and enhanced analytics tools. These features would empower users to execute their strategies more effectively.

3. Increased Community Engagement

Building a strong community around EtherEx is essential for its growth. The platform may implement initiatives to foster community engagement, such as exclusive events, educational resources, and regular updates on platform developments.

4. Partnerships and Integrations

EtherEx may pursue partnerships with other DeFi projects, expanding its ecosystem and providing users with greater opportunities for yield farming, lending, and borrowing. Integrating with other platforms can enhance the overall utility of EtherEx.

5. Global Outreach

As the demand for decentralized trading solutions grows worldwide, EtherEx may focus on increasing its presence in emerging markets. This could involve localized marketing strategies and adaptations to meet regional regulatory requirements.

EtherEx stands at the forefront of the decentralized finance landscape, offering a user-friendly platform for trading Ethereum-based assets. By prioritizing security, transparency, and user empowerment, EtherEx seeks to provide a compelling alternative to traditional centralized exchanges.

As the platform continues to evolve, it holds significant potential to reshape how users interact with digital assets and engage in trading activities. Whether you are a casual trader, a liquidity provider, or an active investor, EtherEx equips you with the tools and resources necessary to navigate the ever-changing world of DeFi.

In a future where decentralized finance is likely to play an increasingly prominent role in financial interactions, EtherEx exemplifies the potential for innovation and empowerment within the ecosystem. Embrace the opportunities that EtherEx presents and embark on your journey into the decentralized world of trading.

AI Website Creator